current assets current liabilities,Current Ratio Formula ,current assets current liabilities,Current Ratio = Current Assets / Current Liabilities. Example of the Current Ratio Formula. If a business holds: Cash = $15 million; Marketable securities = $20 million; Inventory = $25 million; Short-term debt = $15 million; Accounts . This is a complete guide on how to spot a fake Christian Dior bag. Learn exactly how to identify replica Dior in 2024. thepursequeen Reviews of authentic and replica handbags, alongside .

# Introduction

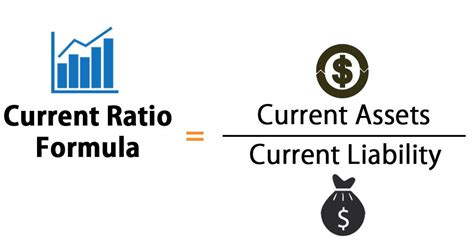

In the realm of financial analysis, understanding the composition and relationship between current assets and current liabilities is crucial for assessing a company's short-term financial health. This article delves into the definitions, importance, and practical applications of current assets and current liabilities, with a focus on the current ratio as a key metric.

# Definition and Composition

Current Assets: Current assets encompass resources that are expected to be converted into cash or used up within one year or the operating cycle of a business. These typically include:

1. Cash and Cash Equivalents: Immediate funds and near-cash assets.

2. Marketable Securities: Investments readily convertible into cash.

3. Short-term Receivables: Amounts owed to the company by customers.

4. Inventories: Goods held for sale or raw materials for production.

5. Prepayments: Advances or payments made for future expenses.

Current Liabilities: Current liabilities represent debts and obligations due within one year or the operating cycle. Examples include:

1. Accounts Payable: Amounts owed to suppliers for goods or services.

2. Short-term Borrowings: Loans or credit lines due for repayment.

3. Accrued Expenses: Unpaid expenses incurred but not yet billed.

4. Current Portion of Long-Term Debt: Principal payments due within one year.

5. Income Taxes Payable: Taxes owed to governmental authorities.

# Current Ratio: Formula and Significance

The current ratio is a fundamental metric used to gauge a company's short-term liquidity, calculated as:

\[ \text{Current Ratio} = \frac{\text{Current Assets}}{\text{Current Liabilities}} \]current assets current liabilities

This ratio indicates the company's ability to cover its short-term obligations with its current assets. A ratio above 1.0 suggests that the company has more current assets than current liabilities, indicating a stronger ability to meet its short-term obligations.

# Current Ratio Explained With Formula and Examples

For instance, if a company has current assets totaling $500,000 and current liabilities amounting to $250,000, the current ratio would be:

\[ \text{Current Ratio} = \frac{500,000}{250,000} = 2.0 \]

This means the company has twice the amount of current assets compared to its current liabilities, which is generally considered favorable as it signifies a strong liquidity position.

# Differences Between Current Assets and Current Liabilities

Nature and Timing:

- Current Assets: Resources expected to be converted into cash or consumed within a year.

- Current Liabilities: Debts and obligations due within a year or the operating cycle.

Risk and Management:

- Current Assets: Managed to ensure adequate liquidity without excessive idle cash.

- Current Liabilities: Managed to balance debt repayment schedules and operational cash flow needs.

# Current Assets vs. Current Liabilities: Key Differences Explained

Focus and Purpose:

- Current Assets: Enhance liquidity and operational flexibility.

- Current Liabilities: Finance short-term operational needs and obligations.

Impact on Financial Health:

- Current Assets: Reflects the company's ability to fund ongoing operations.

- Current Liabilities: Indicates the immediate financial obligations that must be met.

# Current Liabilities: Definition, Examples, and Formula

Definition: Current liabilities encompass obligations due within one year or the operating cycle, including:

- Accounts payable

- Short-term borrowings

- Accrued expenses

- Current portion of long-term debt

- Income taxes payable

# Current Ratio Formula and Interpretation

\[ \text{Current Ratio} = \frac{\text{Current Assets}}{\text{Current Liabilities}} \]

- Interpretation:

- A ratio > 1.0 indicates the company can cover its short-term liabilities.

- A ratio < 1.0 implies potential liquidity issues.

current assets current liabilities The B23 high-top sneaker is set apart by its layering of transparent paneling and white Dior Oblique canvas. Essential details, such as eyelets and a lace-up front, a white rubber sole, a .

current assets current liabilities - Current Ratio Formula